Lauders Capital

Australia is the world’s sixth largest country by land mass and comparable in size to the United States with just one tenth of the population. Large areas of developable land exist in major cities and regional areas, with demand driven by population growth.

Australia has one of the most diverse and advanced economies in the world with a robust and resilient property market that is resisting global downward trends. The low volatility of Australian property has made it a preferred choice for investors.

Australia’s status as a safe haven is underpinned by a legacy of democracy, government stability, forward-looking land development planning and strict adherence to process, procedure, legislation and accountability. The Australian government welcomes offshore investors and does not employ restrictive foreign investment laws or banking regulations that can be encountered in other countries.

Australia has recently been identified as of one of the top ten countries to buy real estate, with inbound investments forecast to increase sharply in 2021. Australia’s rapidly recovering economy and geographic isolation are the main reasons international buyers are interested in the market (Savills 2021 global outlook).

The recovering economy is due, in part, to buoyancy in Australian residential property that has been sustained through an extended COVID-19 lockdown during 2020. A range of policy measures are contributing to this ongoing strength and the country’s safe haven status for investors.

Lauders Capital has been providing wealth creation opportunities (primarily through Australian residential property) for more than twenty years. With an enviable track record, Lauders Capital has the holistic expertise to understand risks, solve problems and deliver projects on time and as planned.

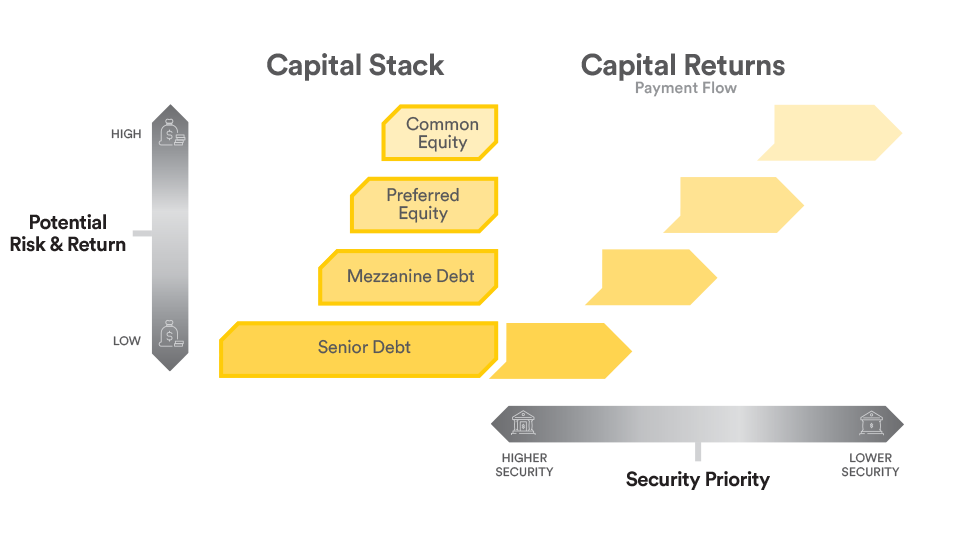

The risk-reward equation is the key consideration for all investors across all sectors. In property development, this equation often appears complex due to the variety of investment opportunities and entry points into the pathway of a project. These different sources of finance, referred to as a ‘capital stack’, relate to the layering of each source and how each has its own collateral, return expectations and repayment priority.

The capital stack typically consists of four funding classes, ‘stacked’ on top of each other, to fund a project. They are defined by parameters including reward, risk, length of investment, stage of entry into the investment pathway and rights to assets and in what order—the ‘payment waterfall’—as displayed in the figure below. Understanding the parameters of each class of investment is a crucial part of the due diligence process, as it offers quantification of the potential upside (and potential downside).

Essentially, the structure, and an investor’s place within that structure, determines how and when an investor will be reimbursed and whether the investor has the ability to take control of the underlying property. The figure below provides a schematic representation of the interplay between funding class in the capital stack and the payment waterfall.

Common Equity holders sit at the top of the stack and have ‘ownership’ in the project, with the chance to enjoy the highest returns from a project that performs well. The risk for equity holders is that they are last in line in the payment waterfall, so, where a project does not perform as expected, low returns or even loss of equity can result. Equity is generally a longer-term investment.

Preferential Equity (Pref equity) can be structured in a number of ways; fundamentally, however, the principal amount and the agreed interest or return is paid from profits of the project. Pref equity investors are paid before regular equity holders. Should the project not perform as expected, Pref equity holders may not receive the expected returns.

Mezzanine Debt (Mezz debt) receives a higher rate of return compared to senior debt as this is debt that is not secured by the property. Mezz debt is often a medium-term investment, however, this is generally repaid as soon as possible by the project (if allowed by the holder of the senior debt).

Senior Debt sits at the bottom of the stack, offering the lowest risk to the debt provided and, consequently, the lowest return. Senior debt has repayment priority and will almost always hold a mortgage over the property. The holder of the senior debt has the right to take ownership of the security to ensure repayment.

Schematic representation of the interplay between the capital investment class (Capital Stack)

and the priority of payment for each class of investment (Payment Waterfall)

Lauders Group is renowned for buying smart and delivering successfully. Buying smart entails a comprehensive analysis, costing and modelling for potential land developments. The initial modelling is the foundation for a project’s success and the Lauders team has demonstrated, consistently, an exceptional ability to capture the correct inputs to provide accurate feasibility for success and returns. This platform provides a basis for the practical application by our highly qualified and experienced professionals across all aspects of the development project. It is the high-quality end-to-end service that sets Lauders apart from many of its competitors.

Taking a property from a broad hectare, agricultural parcel through to a permitted, development-ready project site includes pre-purchase analysis, feasibility, site acquisition and structuring, design, permits and approvals, financial administration, project financing, contract administration, sales, marketing and investor management.

The time frame of each stage is determined by factors including government policy, infrastructure availability and macro-economics. Investors who enter into the project in the early stages of the process harbour the greatest risk but enjoy the greatest rewards.

Metropolitan Strategy Plan Melbourne’s maps the vision for growth within Melbourne’s UGB 2017–2035. It sets the strategy for supporting jobs, housing and transport, while building on Melbourne’s legacy of distinctiveness, liveability and sustainability.

Growth Corridor Plans (GCPs) High-level integrated land use and transport plan that provides a strategy for the development of jobs, transport, town centres, open space and key infrastructure for new suburbs (7–5 years to project pre-sales).

Precinct Structure Plans (PSPs) Sets the future structure of a new suburb, with more detail on the land use defined by the GCP. The PSP is incorporated into the local planning scheme to guide the use and development of land in the precinct over the long term. Once the PSP has been gazetted much of the planning risk has been removed (2–4 years to project pre-sales).

Planning Permits Issued in response to an application for a permit to subdivide, develop or use a parcel of land in accordance with the PSP (3–6 months to project pre-sales).